Financial protection acts obama

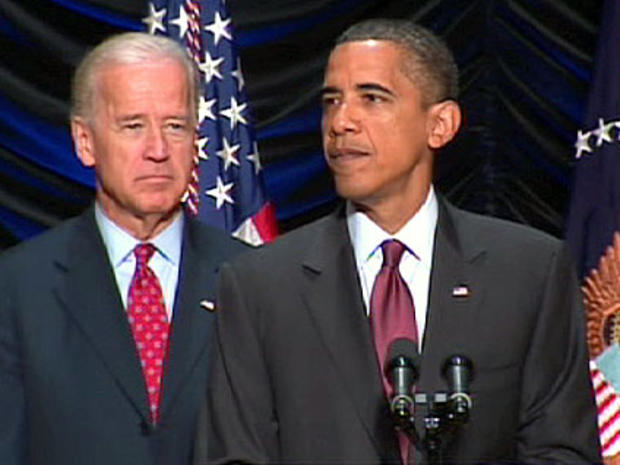

Updated 12:39 p.m. Eastern Time President Obama today signed into law the most sweeping financial industry reform legislation since the Great Depression, hailing the reforms as establishing "the strongest consumer financial protections in history." "These protections will be enforced by a new consumer watchdog with just one job: looking out for people - not big banks, not lenders, not investment houses - looking out for people as they interact with the financial system," said the president.

Updated 12:39 p.m. Eastern Time President Obama today signed into law the most sweeping financial industry reform legislation since the Great Depression, hailing the reforms as establishing "the strongest consumer financial protections in history." "These protections will be enforced by a new consumer watchdog with just one job: looking out for people - not big banks, not lenders, not investment houses - looking out for people as they interact with the financial system," said the president.  "It is designed to make sure that everyone follows the same set of rules, so that firms compete on price and quality, not on tricks and not on traps," he said. "It demands accountability and responsibility from everyone. It provides certainty to everybody from bankers to farmers to business owners to consumers."

"It is designed to make sure that everyone follows the same set of rules, so that firms compete on price and quality, not on tricks and not on traps," he said. "It demands accountability and responsibility from everyone. It provides certainty to everybody from bankers to farmers to business owners to consumers."

"And unless your business model depends on cutting corners or bilking your customers, you've got nothing to fear from this reform," he added. Also present for the signing at the Ronald Reagan building in Washington were two Americans, Robin Fox and Andrew Giordano, who had faced a credit card interest rate increase and overdraft fees. The president pointed to the impact the legislation would have on people like them in an effort to stress its importance for average Americans. "With this law, unfair rate hikes, like the one that hit Robin, will end for good," he said. "And we'll ensure that people like Andrew aren't unwittingly caught by overdraft fees when they sign up for a checking account." Financial Reform Bill Passes: What's In It For You?

5 Ways the Financial Reform Law Changes Your Money Habits Mr. Obama said the bill would rein in risky Wall Street practices and bring transparency to the complex transactions that helped cause the financial crisis. He also noted that it gives shareholders greater say in compensation for CEOs and high-ranking executives. The president did acknowledge that much of the impact of the bill will ultimately be left to regulators and that companies will still have leeway to act irresponsibly. Many provisions in the legislation won't take effect for a year or more as regulators set out the new rules.

"For these new rules to be effective, regulators will have to be vigilant," he said. "We also may need to make adjustments along the way as our financial system adapts to these new changes and changes around the globe. No law can force anybody to be responsible; it's still incumbent on those on Wall Street to heed the lessons of this crisis in how they conduct their businesses." Close to 400 people were present for the signing, including business leaders (among them Citi CEO Vikram Pandit), lawmakers and consumer advocates. Also present was Elizabeth Warren, among the top candidates to run the Bureau of Consumer Financial Protection.

Battle Brews in Naming Financial Watchdog Head The president concluded his remarks by stating that there is "no dividing line between Main Street and Wall Street."

"In the end, our financial system only works - our market is only free - when there are clear rules and basic safeguards that prevent abuse, that check excess, that ensure that it is more profitable to play by the rules than to game the system," he said. "And that's what these reforms are designed to achieve: no more, no less. Because that is how we will ensure that our economy works for consumers, that it works for investors, that it works for financial institutions - that it works for all of us." Special Section: Wall Street Under Fire

Brian Montopoli is the national reporter and political analyst for CBSNews.com.

© 2010 CBS Interactive Inc. All Rights Reserved.

Updated 12:39 p.m. Eastern Time President Obama today signed into law the most sweeping financial industry reform legislation since the Great Depression, hailing the reforms as establishing "the strongest consumer financial protections in history." "These protections will be enforced by a new consumer watchdog with just one job: looking out for people - not big banks, not lenders, not investment houses - looking out for people as they interact with the financial system," said the president.

Updated 12:39 p.m. Eastern Time President Obama today signed into law the most sweeping financial industry reform legislation since the Great Depression, hailing the reforms as establishing "the strongest consumer financial protections in history." "These protections will be enforced by a new consumer watchdog with just one job: looking out for people - not big banks, not lenders, not investment houses - looking out for people as they interact with the financial system," said the president.  "It is designed to make sure that everyone follows the same set of rules, so that firms compete on price and quality, not on tricks and not on traps," he said. "It demands accountability and responsibility from everyone. It provides certainty to everybody from bankers to farmers to business owners to consumers."

"It is designed to make sure that everyone follows the same set of rules, so that firms compete on price and quality, not on tricks and not on traps," he said. "It demands accountability and responsibility from everyone. It provides certainty to everybody from bankers to farmers to business owners to consumers."